Of 198 Countries, compared on the percentage change in GDP between 2007 and 2009, the most impacted countries are predominantly Eastern European and trade-dependent advanced economies.

The most affected countries Estonia (#1) and Ukraine (#3), still had depressed economies 5 years later, 5-7% below pre-crisis GDP levels.

Those that were least affected by the Financial Crisis are primarily African countries, as well as China.

The full list, constructed from World Bank GDP data, is below. Total growth since 2007 is calculated for each country until 2012. The countries are ranked based on the total GDP growth between 2007 and 2009. Download the full spreadsheet here.

Long-Run Impacts of the Financial Crisis

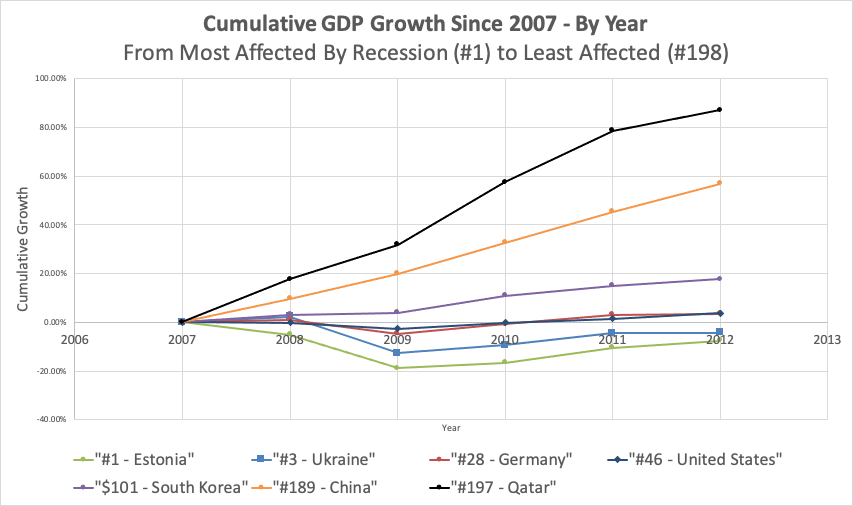

The graph below illustrates the trajectory of growth since 2007, showing the striking difference in long term outcomes due to the varying effect of the financial crisis on each country.

The most affected countries Estonia (#1) and Ukraine (#3), still had depressed economies 5 years later, 5-7% below pre-crisis GDP levels.

Advanced economies like the US (#46) and Germany (#28) didn’t return to 2007 levels until 2010, and by 2012, had only grown by about 3.5% over 5 years.

Least affected countries like Qatar (#197) and China (#189), never went into negative growth, and over 5 years had grown by 75% and 60%, respectively.

The degree of variation in response to the crisis is astonishing and it’s natural to wonder why there is such a difference.

Why The Different Outcomes?

Financial Institutions

As usual, institutions matter. In this case, we’re referring to the financial institutions each country had. Since this was a financial crisis, generally, the more integrated a country’s financial systems were with the rest of the world, the more they were affected.

This explains why advanced economies like the US, United Kingdom, and Germany were among the most affected.

International Trade

Studies show that the trade collapse following the Great Recession was the largest since the Great Depression. Thus, countries relying on exporting their products or raw materials were particularly affected. Additionally, countries that export tourism (provide a service to foreigners), were also highly affected, as consumers switched into savings mode.

Government Intervention

Governments varied in their response to the crisis in utilizing their two economic tools of fiscal and monetary policy. Fiscal policy refers to government spending, either in the form of cash transfers to its citizens or in the form of investments in infrastructure. Monetary policy refers to the monetary supply in the economy, this lever controls the economy’s interest rate and inflation rate. I’ve written about the United States’ response to the financial crisis in another article.

China adopted a more serious fiscal stimulus package than other countries, stimulating investment in infrastructure, creating a healthy recovery. Countries that trade heavily with China benefited from its strong recovery and thus also experienced better recoveries. This includes much of Africa.

Notes:

Analysis based on World Bank Indicator “GDP (Constant 2010 US$)”

Several countries excluded due to missing data or high variation unrelated to the 2008 recession.